Challenges in Supply Chain Management for Mining Industry Companies in India

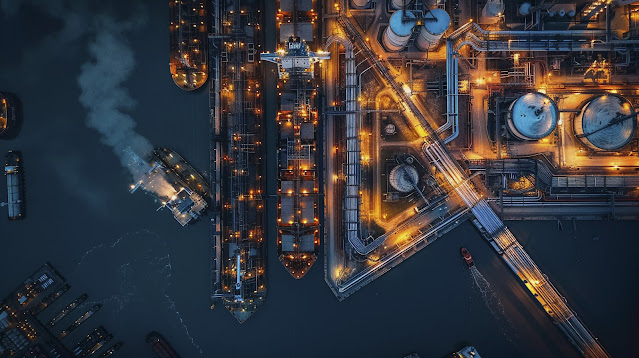

The mining sector plays a pivotal role in India’s economic growth, providing essential raw materials such as coal, iron ore, bauxite, and limestone that drive industries ranging from steel and power to cement and infrastructure. While mining industry companies in India contribute significantly to the nation’s industrial base, one of their biggest hurdles lies in managing a complex and often unpredictable supply chain. Effective supply chain management in the mining industry is critical to ensuring operational efficiency, cost optimization, and timely delivery of resources, but several challenges continue to persist.

1.

Geographical and Infrastructure Barriers

Mining operations are typically

located in remote and geographically challenging areas. Poor road connectivity,

limited access to ports, and underdeveloped rail networks increase logistical

costs and delays. Transporting bulk minerals like coal and iron ore to

manufacturing hubs remains a major bottleneck for mining industry companies in

India.

2.

Regulatory and Policy Hurdles

Frequent changes in government

policies, environmental regulations, and land acquisition laws disrupt supply

chains. Mining companies often face long delays in getting approvals for

mining, transportation, and exports. These regulatory uncertainties add

complexity to supply chain management in the mining industry.

3.

High Transportation and Logistics Costs

Given the bulk nature of minerals,

transportation accounts for a significant share of total costs. The dependency

on road and rail, coupled with rising fuel prices, leads to inflated logistics

expenses. Moreover, bottlenecks at ports and railways worsen the problem,

affecting delivery timelines.

4.

Inventory and Storage Challenges

Mining industry companies in India

must manage large inventories of raw materials and finished products. However,

inadequate warehousing and storage facilities, particularly in rural and mining

areas, increase risks of material loss, damage, or inefficiency in stock

management.

5.

Technology Adoption Gap

While advanced economies have

embraced digital tools like IoT, AI, and blockchain to enhance supply chain

visibility, Indian mining companies are still lagging. Limited investment in

automation and real-time tracking makes it difficult to manage demand forecasting,

transportation, and procurement effectively.

6.

Environmental and Sustainability Pressures

With increasing global focus on

sustainable mining practices, companies are under pressure to ensure that their

supply chains are environmentally responsible. Reducing carbon emissions from

transport, ensuring ethical sourcing, and adhering to ESG (Environmental,

Social, and Governance) standards create additional challenges for supply chain

management in the mining industry.

7.

Workforce and Safety Issues

Mining is labor-intensive, and the

supply chain depends heavily on workforce efficiency. Strikes, labor shortages,

or safety issues can disrupt the movement of materials across the value chain,

leading to delays and increased costs for mining industry companies in India.

8.

Global Market Volatility

The mining supply chain is also

influenced by global market dynamics. Fluctuations in demand and commodity

prices, trade restrictions, or international crises such as pandemics and

geopolitical conflicts can disrupt the steady flow of raw materials.

Conclusion

For

companies like Naarayani Minerals Pvt Ltd,

overcoming these supply chain challenges requires a holistic approach.

Investment in digital supply chain technologies, public-private partnerships to

improve logistics infrastructure, and stronger regulatory frameworks are

crucial steps forward. Additionally, adopting sustainable practices and

building resilient supplier networks will help mining companies stay

competitive in the global market.

Effective supply chain management

in the mining industry is no longer just about moving materials; it is

about building a robust, agile, and sustainable system that supports India’s

long-term industrial growth.

Comments

Post a Comment